'It'll never happen to me' is a phrase I hear time and time again in this world. For some unknown reason, people hold the perception that everyone else gets ill or injured, and that they are somehow inviolate. I once starred in a Channel 4 programme called 'It happened to me', because it really did, and in a major way...

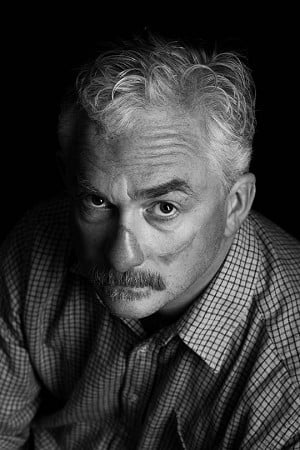

Working in the outdoors is a wonderful way to live your life. All the fresh air, mountains, rivers and open country you could ever wish for will come your way (as well as rain, cloud and snow!). Safety is paramount, and we should all be well trained in what disciplines we work in and teach. I felt well trained and ready for a daring alpine style climb on Mt McKinley some years ago, but that didn't stop the weather doing its best to freeze me to death at 20,000ft. I was lucky enough to be rescued, but suffered severe frostbite injuries to my face, hands and feet. Two years of hospital care followed, where I lost all my toes, fingertips and nose. This included over a year off work, followed by weeks here and there for skin grafts and reconstructive surgery. Fifteen years on I still have podiatry on my stubby feet to keep them in condition. Thankfully I was well insured and all my medical and hospital bills were covered (over $40,000 for two weeks care in the USA alone). My travel insurance paid the medical bills, but my sickness and accident cover kept me afloat. I cannot stress enough, the necessity to prepare yourself for illness or injury in the outdoors. I wonder how many of you have even considered it?

When a policy pays is also something worth looking into. Some are weeks, some are months. Can you survive six weeks or six months without any money coming in? Statutory Sick Pay certainly isn't going to pay all the bills, so think what your outgoings are and write them all down. You'll be surprised how much those monthly direct debits come to. The last thing you want when you're ill is the stress of your home or vehicle being repossessed and people knocking at your door. Policies exist which can cover Mortgage, Family, Income Protection and Critical Illness cover, and I would advise anyone to seriously consider them.

When I was lying in bed covered in frostbite, with parts of my body dying before my eyes, the one thing I didn't have to worry about was my finances. It's easy to say now, but at the time I had more than enough on my plate…

Nigel Vardy

To read more about Nigel's experiences you can visit his website - www.mrfrostbite.com - and follow him on Twitter @NigelVardy

Comments